International borders have reopened and revenge travel is in full swing for most of us.

Every long weekend with a public holiday is an opportunity to escape Singapore, whether it’s to a nearby destination like Malaysia, or somewhere further such as South Korea or Japan.

If you are thinking of travelling, here are three tips you need to save some money on your trips.

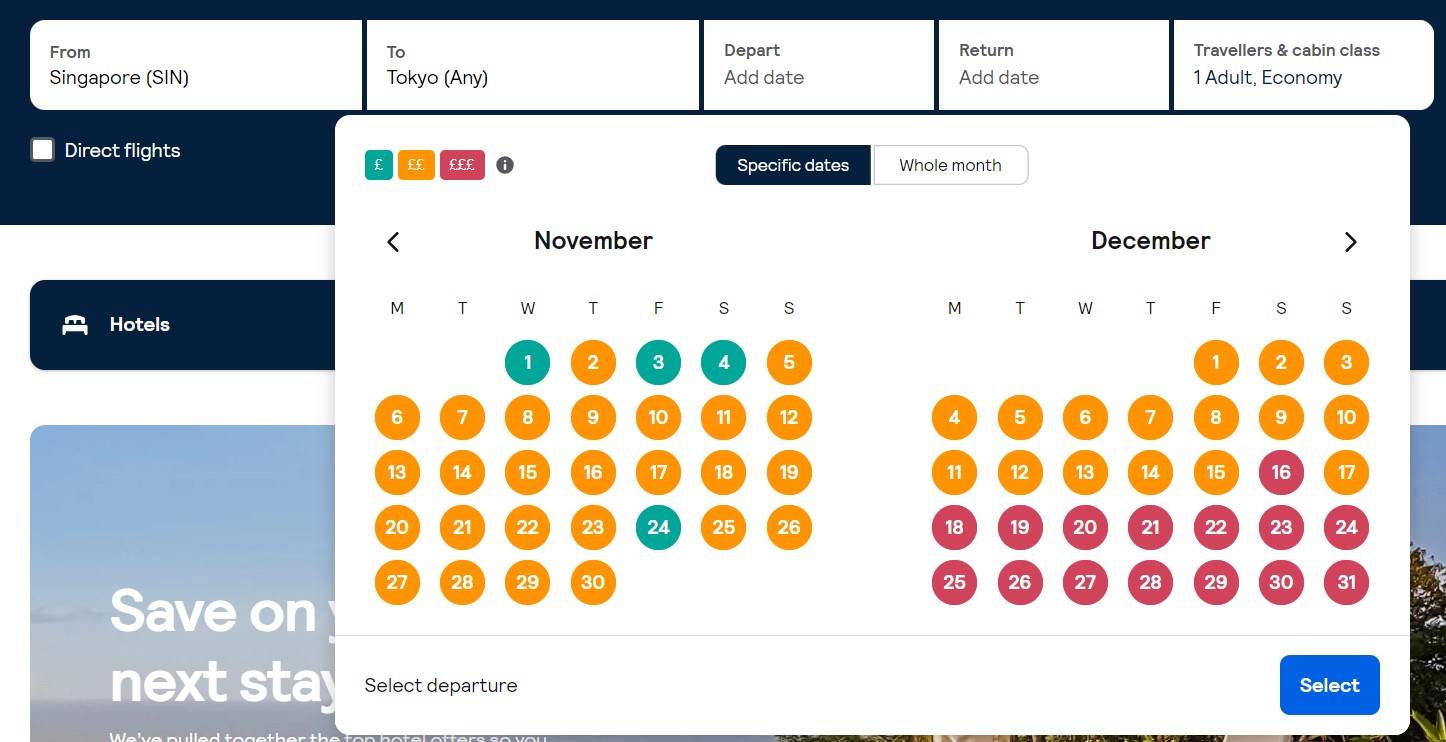

1. Book your holidays early or look at travelling during the off-peak season

If you are thinking of booking a trip to Hokkaido in December right now, air fares for this period have already increased due to high demand (and there are still four months to go until then).

Screenshot via Skyscanner

Screenshot via SkyscannerTo avoid spending a lot on your flights, book your flight and accommodations a year in advance before prices start to spike.

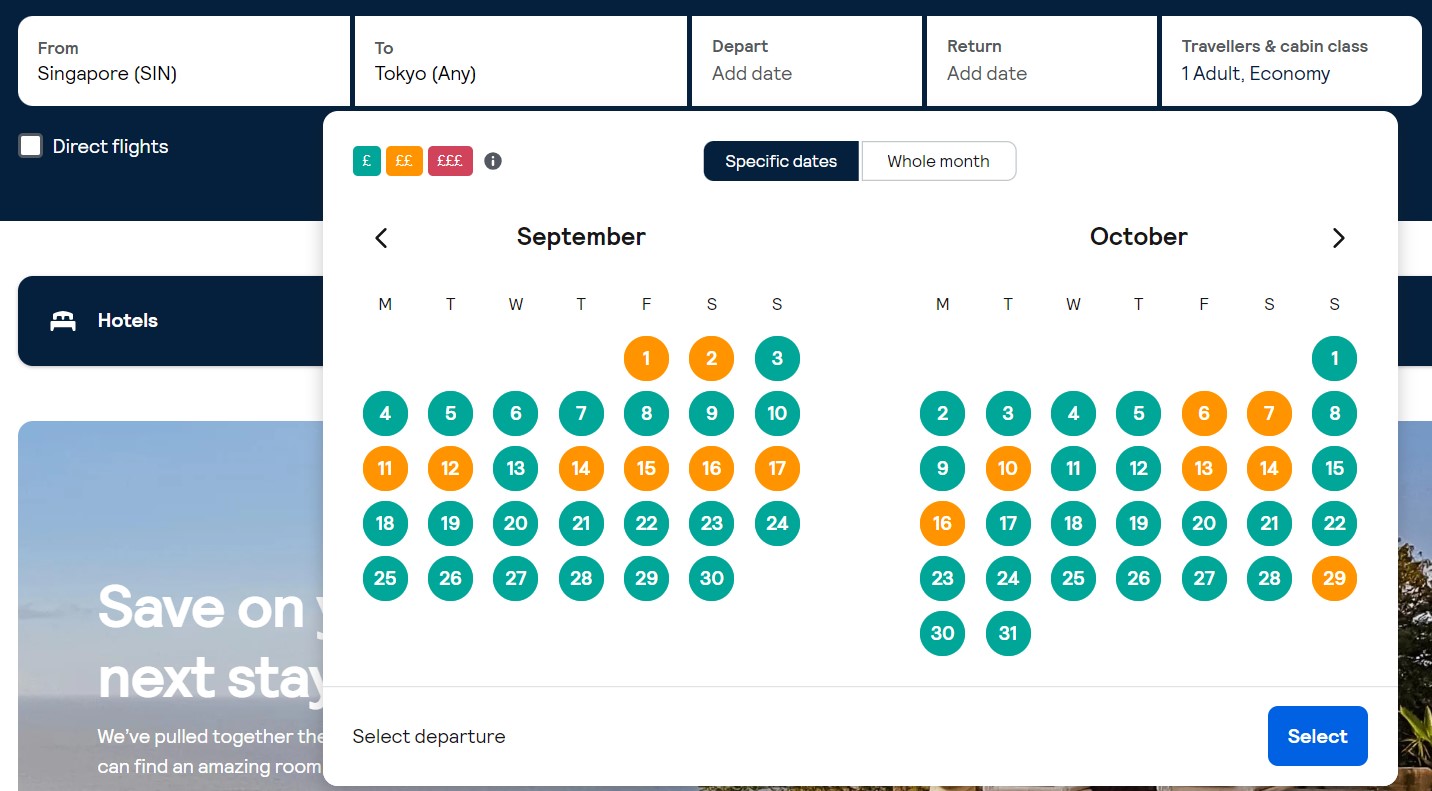

Alternatively, you could consider travelling during the off-peak season when flight and accommodation prices tend to be cheaper.

Screenshot via Skyscanner

Screenshot via SkyscannerTravelling during off-peak season also means being able to enjoy your holiday with fewer tourists and exploring a different side of your favourite destinations.

For example, if you travel to Hokkaido in September or October, you will be able to enjoy sights of the leaves changing colour, as well as the full range of the region’s seasonal harvest of seafood and agricultural products at the Sapporo Autumn festival.

Compare prices on multiple booking sites, including prices in local currency

When it comes to accommodations, it pays to be as auntie as possible by comparing prices on multiple booking sites.

A difference of a few dollars per night can translate to quite a bit of cash saved if you are staying for several nights.

From Booking.com to Agoda or even the hotel’s website, check as many websites as possible for the best rates.

Some countries such as Japan have specialised websites such as Rakuten Travel where hotel prices are listed in the local currency.

If you have a VPN, you can use it to change the location of your browser to see if better prices are offered in the local currency.

In such situations, you can save even more money by booking your overseas accommodation with the DBS Visa Debit card.

This card allows you to spend like a local, without overseas transaction fees, in the following 11 currencies:

- Japanese Yen (JPY)

- Australian Dollar (AUD)

- Thai Baht (THB)

- Euro (EUR)

- Sterling Pound (GBP)

- US Dollar (USD)

- Canadian Dollar (CAD)

- Hong Kong Dollar (HKD)

- New Zealand Dollar (NZD)

- Norwegian Kroner (NOK)

- Swedish Kroner (SEK)

In addition, the card provides a 2 per cent cash back on all purchases made in foreign currencies, including online purchases, as long as you hit the minimum spending criteria of S$500 and keep monthly withdrawals below S$400.

If you happen to be a DBS customer, you will be able to offset your flight and hotel bookings through DBS’ Travel and Leisure Marketplace at twice the value on your accumulated DBS Points.

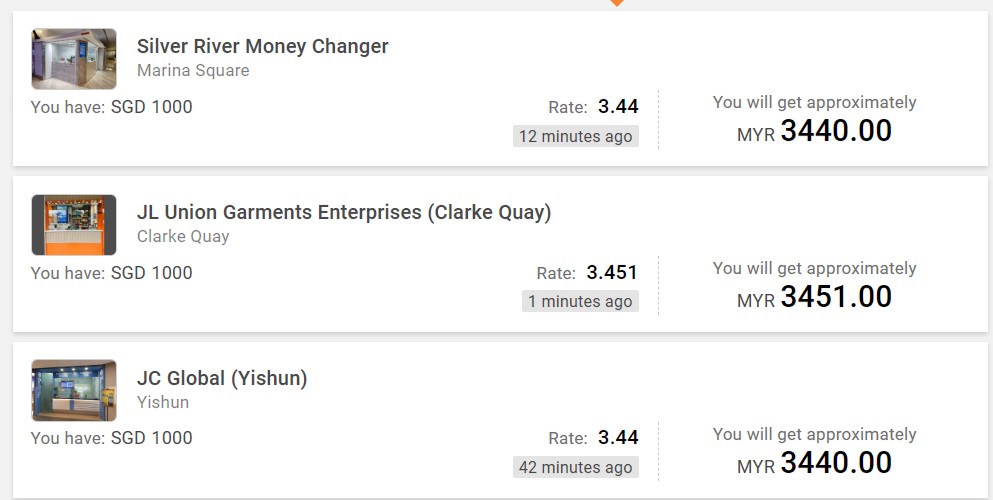

Make sure you’re getting the best bang for your ringgit/baht/won/yen/USD/euro

Singapore’s currency is pretty strong right now vis-a-vis currencies such as the ringgit and yen.

It is therefore a good idea to take advantage of the exchange rate by doing some homework beforehand instead of changing your money at the last minute.

Information on the most attractive exchange rate and the money changer offering it can be easily found at the website CashChanger.

Don’t underestimate the slight difference in exchange rate, as it can make quite the difference when you change a substantial amount of currency.

Screenshot via CashChanger

Screenshot via CashChangerIf you prefer not to hold too much cash on hand, you can skip the hassle of queuing at the ATMs and money changers, and travel cashless with the DBS Visa Debit Card.

You can also use this card as a payment method for ride-hailing apps overseas, such as Grab in Thailand or Uber in Hong Kong, without worrying about additional hidden costs.

As for the potential loss of your card or the theft of your card’s details, you can use DBS Payment Controls on the digibank app to temporarily lock your card, set monthly spending limits, or even disable/enable specific card functions such as overseas in-store transactions to ensure that you are in full control of your cards at any point in time.

Alright, since this card is so convenient, how do I apply for one?

Upon applying for the card here, all you need to do is to open a DBS multi-currency account and link it to the DBS Visa Debit card.

We recommend the DBS My Account, which can be opened through the digibank app for free without an initial deposit or a minimum amount to be maintained in the account.

Here, you can exchange foreign currencies in advance via the digibank app with just a few taps at no foreign exchange conversion fees.

The DBS Visa Debit Card’s transactions will then be deducted directly from your foreign currency wallets in this account so long as you have sufficient foreign currency inside the wallet, so you can essentially use it as a cashless travel wallet for your needs.

That’s not all

There is also an option to enable Travel Mode in the digibank app for the card, so that you will receive a notice if your account’s foreign currency wallets are running low.

These wallets can be topped up easily through the digibank app so you do not have to worry if you cannot find good money changers.

Your overseas spending will also be consolidated in a bank statement so it’s easy to assess if you’ve overspent and hence allows you to manage your vacation budget better.

All in all, the DBS Visa Debit card and My Account is a powerful duo that saves you a whole lot of hassle and helps you maximise your savings on your trips.

You can find out more about the DBS Visa Debit card here and the DBS My Account here.

Important note:

Deposit Insurance Scheme

Singapore dollar deposits of non-bank depositors and monies and deposits denominated in Singapore dollars under the Supplementary Retirement Scheme are insured by the Singapore Deposit Insurance Corporation, for up to S$75,000 in aggregate per depositor per Scheme member by law. Monies and deposits denominated in Singapore dollars under the CPF Investment Scheme and CPF Retirement Sum Scheme are aggregated and separately insured up to S$75,000 for each depositor per Scheme member. Foreign currency deposits, dual currency investments, structured deposits and other investment products are not insured.

This sponsored article by DBS made this writer feel like going to Hokkaido for a holiday in October.

Left photo by Sorasak via Unsplash, right photo by Evan Krause via Unsplash

Bagikan Berita Ini

0 Response to "Not done with revenge travelling? Here's how you can save money to travel even more - Mothership.sg"

Post a Comment